Tax Free Arkansas 2024

Tax Free Arkansas 2024. Calculate payroll costs for up to 20 employees in arkansas in 2024 for free (view alternate tax years available). To estimate your tax return for 2024/25, please select.

Arkansas asset builders is a partner in the irs volunteer income tax assistance (vita) program. For the 2024 tax year, the i.r.s.

August 6, A Wide Variety Of Items.

Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results.

What States Have A Sales Tax Holiday In 2024?

Sarah huckabee sanders, reducing these two taxes will cut $150 million from personal income tax and $36 million from corporate income tax.

The State Charges A Progressive Income Tax, Broken Down Into Six Tax Brackets.

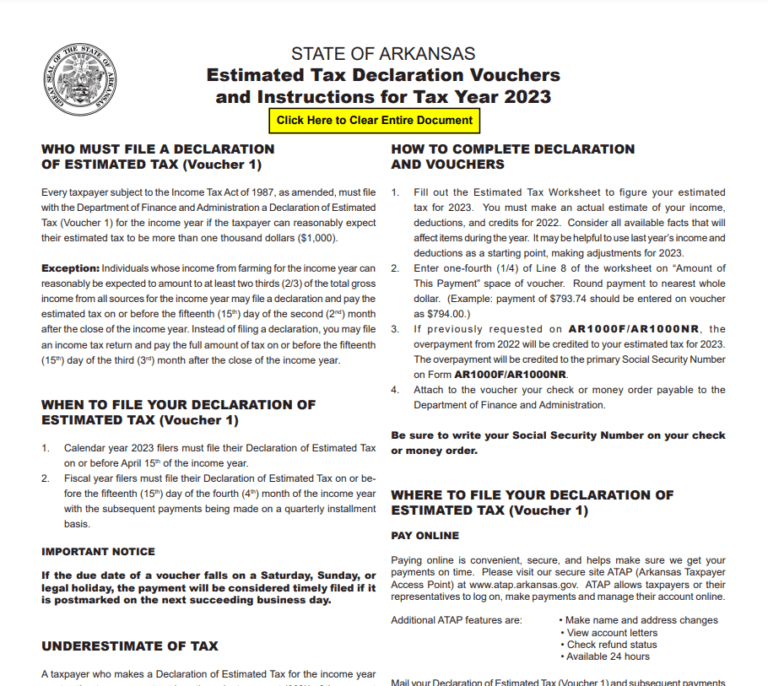

Rd) month after the close of the income year.

Images References :

Source: kygl.com

Source: kygl.com

Tax Free Weekend in Arkansas, Here's What You Need to Know, Arkansas asset builders is a partner in the irs volunteer income tax assistance (vita) program. The income tax rates and personal allowances in arkansas are updated annually with new tax tables published for resident and non.

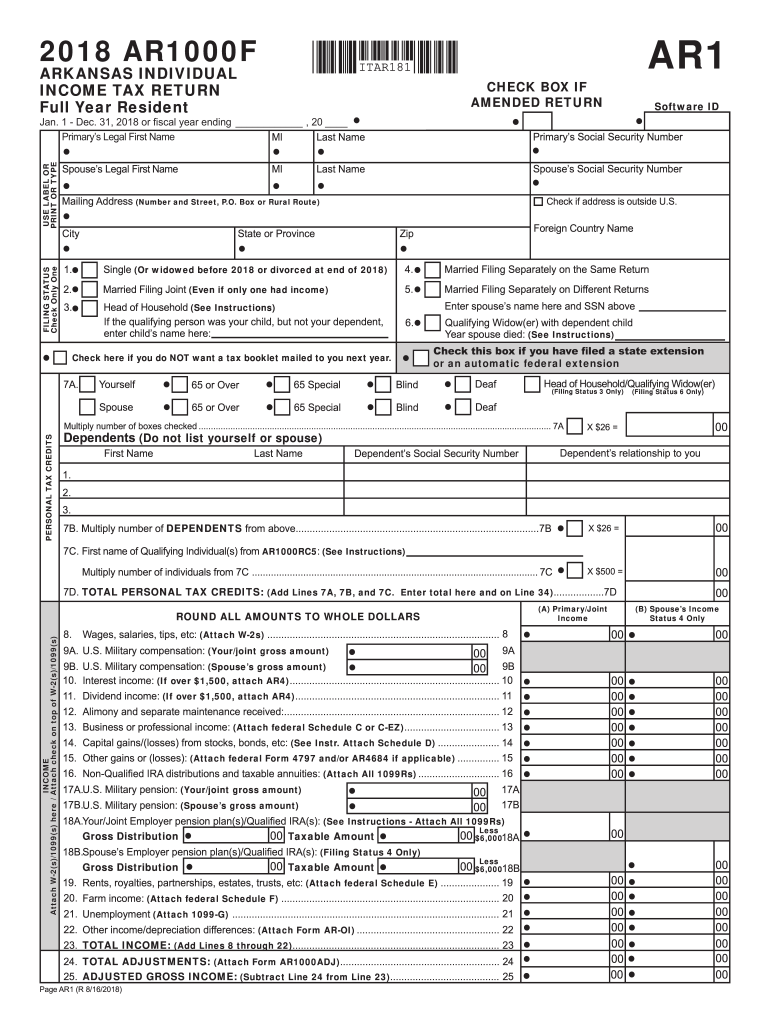

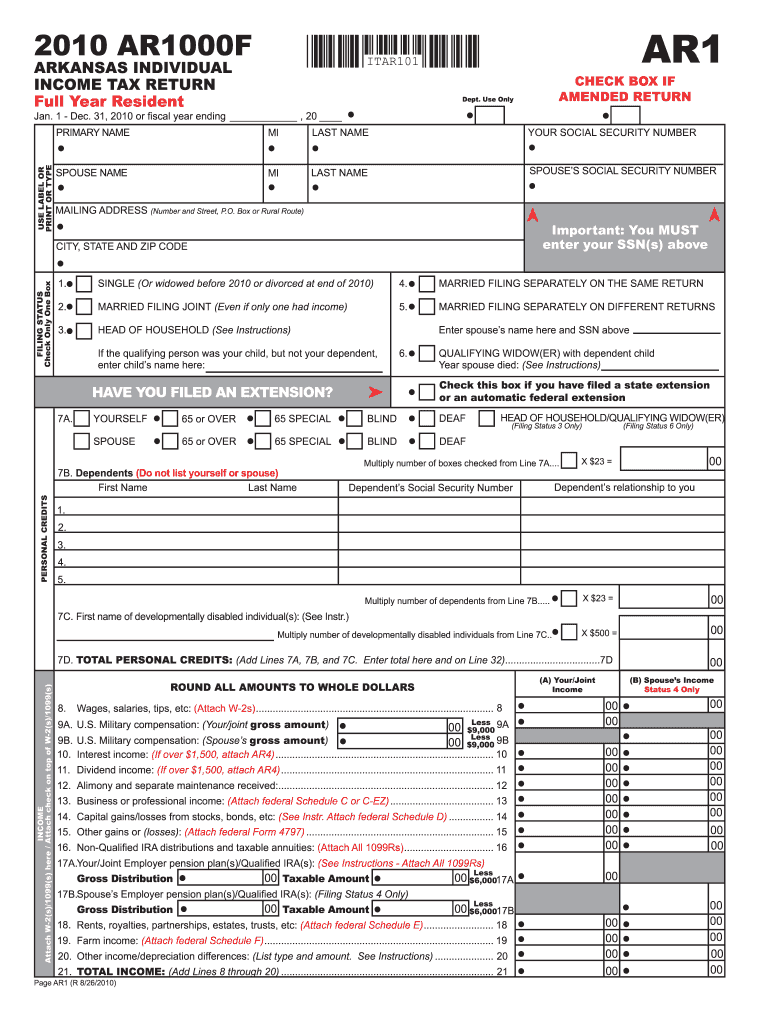

Source: www.employeeform.net

Source: www.employeeform.net

Arkansas Employee Tax Withholding Form 2024, Legislators have reviewed budget proposals ahead of fiscal session. The 2024 tax rates will range from 2% on the low end to 4.4% on the high end.

Source: www.dochub.com

Source: www.dochub.com

Arkansas tax forms Fill out & sign online DocHub, Legislators have reviewed budget proposals ahead of fiscal session. The free online 2024 income tax calculator for arkansas.

Source: www.signnow.com

Source: www.signnow.com

Arkansas State Tax Forms Fill Out and Sign Printable PDF, This offer is limited to three (3) free tax. Said it planned to lower that threshold to $5,000 in aggregate payments annually, with no transaction minimums, before it eventually lowers.

Source: www.thearkansasproject.com

Source: www.thearkansasproject.com

Tax Plan Moves Arkansas in the Right Direction The Arkansas Project, Donald trump, president biden and nikki haley. The arkansas income tax has three tax brackets, with a maximum marginal income tax of 4.90% as of 2024.

Source: www.dochub.com

Source: www.dochub.com

Arkansas state tax form 2022 pdf Fill out & sign online DocHub, Review the full instructions for using the arkansas salary after tax calculators which details arkansas tax allowances and deductions that can be calculated by altering the standard. Calculate your annual take home pay in 2024 (that’s your 2024 annual salary after tax), with the annual arkansas salary calculator.

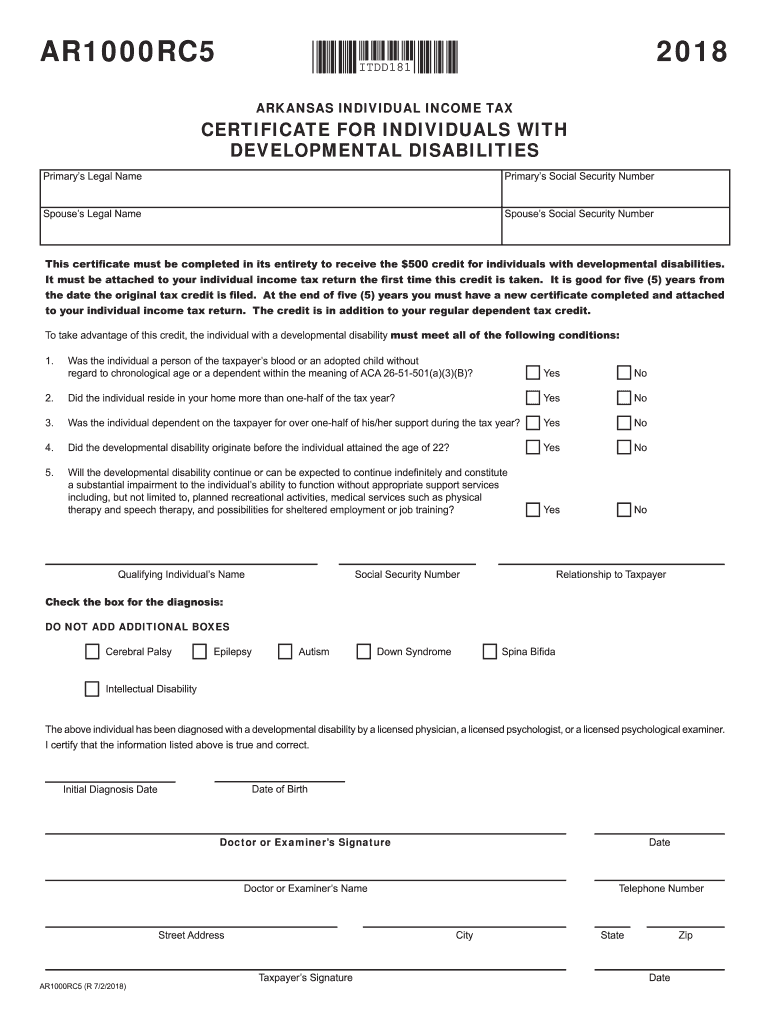

Source: www.signnow.com

Source: www.signnow.com

Ar1000rc5 Arkansas 20182024 Form Fill Out and Sign Printable PDF, Sarah huckabee sanders, reducing these two taxes will cut $150 million from personal income tax and $36 million from corporate income tax. Tax free weekend in arkansas, here's what you need to know, aug 1, 2023 / 08:00 am cdt.

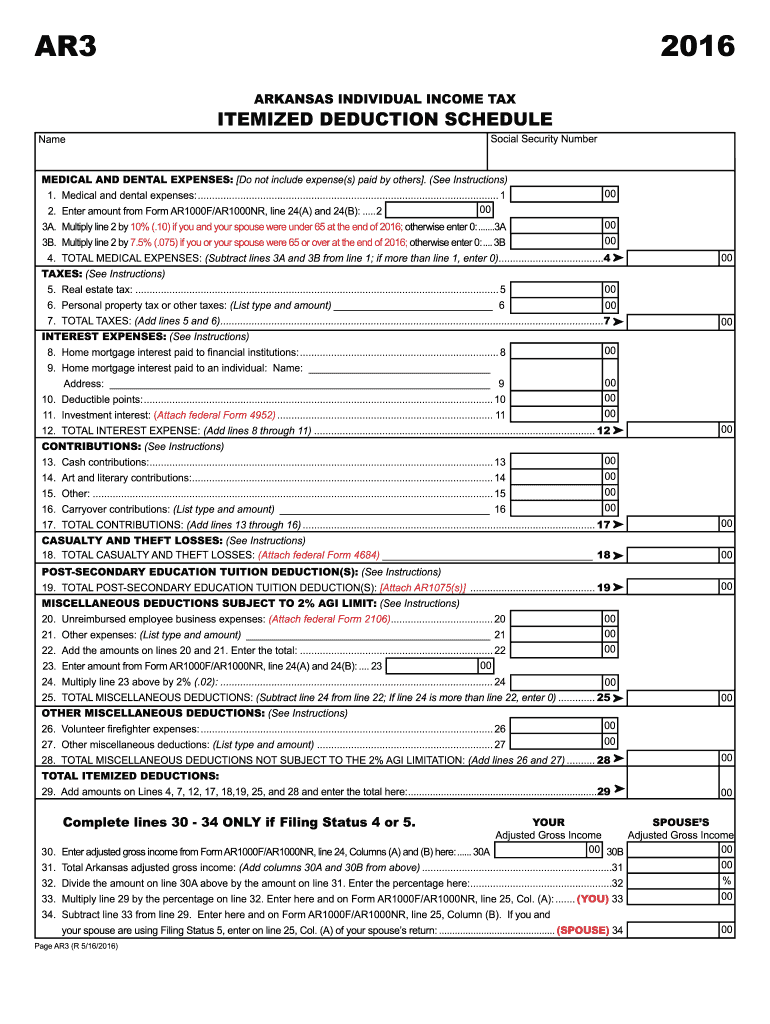

Source: www.signnow.com

Source: www.signnow.com

Tax Ar3 20162024 Form Fill Out and Sign Printable PDF Template signNow, Th) day of the third (3. You can find detailed information on how to calculate payroll in.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, You can find detailed information on how to calculate payroll in. The law will cut income taxes in the state of arkansas.

Source: printablerebateform.net

Source: printablerebateform.net

Arkansas Tax Rebate 2023 Printable Rebate Form, The senate committee on revenue and taxation quickly passed an income tax cut package through senate bill 8 by sen. Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results.

Calculate Your Annual Take Home Pay In 2024 (That’s Your 2024 Annual Salary After Tax), With The Annual Arkansas Salary Calculator.

The income tax rates and personal allowances in arkansas are updated annually with new tax tables published for resident and non.

Updated On Feb 16 2024.

Rd) month after the close of the income year.

Updated For 2024 With Income Tax And Social Security Deductables.

The 2024 tax rates will range from 2% on the low end to 4.4% on the high end.